All Categories

Featured

Table of Contents

Maintaining all of these phrases and insurance policy types straight can be a migraine. The adhering to table puts them side-by-side so you can rapidly differentiate among them if you obtain perplexed. Another insurance policy protection type that can pay off your mortgage if you die is a typical life insurance policy plan

A is in place for a set number of years, such as 10, 20 or 30 years, and pays your recipients if you were to pass away throughout that term. A provides insurance coverage for your entire life period and pays out when you pass away.

One common general rule is to go for a life insurance policy plan that will certainly pay out approximately 10 times the insurance policy holder's income amount. Conversely, you might choose to make use of something like the DIME method, which includes a family members's financial obligation, income, home mortgage and education costs to determine how much life insurance policy is required (mortgage insurance policy).

It's also worth noting that there are age-related limitations and thresholds enforced by almost all insurance providers, who often won't give older buyers as many alternatives, will bill them extra or may reject them outright.

Below's just how home loan protection insurance determines up versus conventional life insurance policy. If you're able to get term life insurance policy, you should avoid home loan protection insurance coverage (MPI). Contrasted to MPI, life insurance policy offers your family members a cheaper and extra versatile benefit that you can count on. It'll pay out the same quantity no issue when in the term a fatality occurs, and the cash can be used to cover any type of costs your family regards necessary back then.

In those scenarios, MPI can provide great assurance. Simply make sure to comparison-shop and check out all of the small print prior to registering for any type of plan. Every home mortgage defense alternative will certainly have various guidelines, regulations, benefit options and downsides that need to be considered very carefully against your precise circumstance (mortgage job loss insurance canada).

Legal And General Mortgage Payment Protection

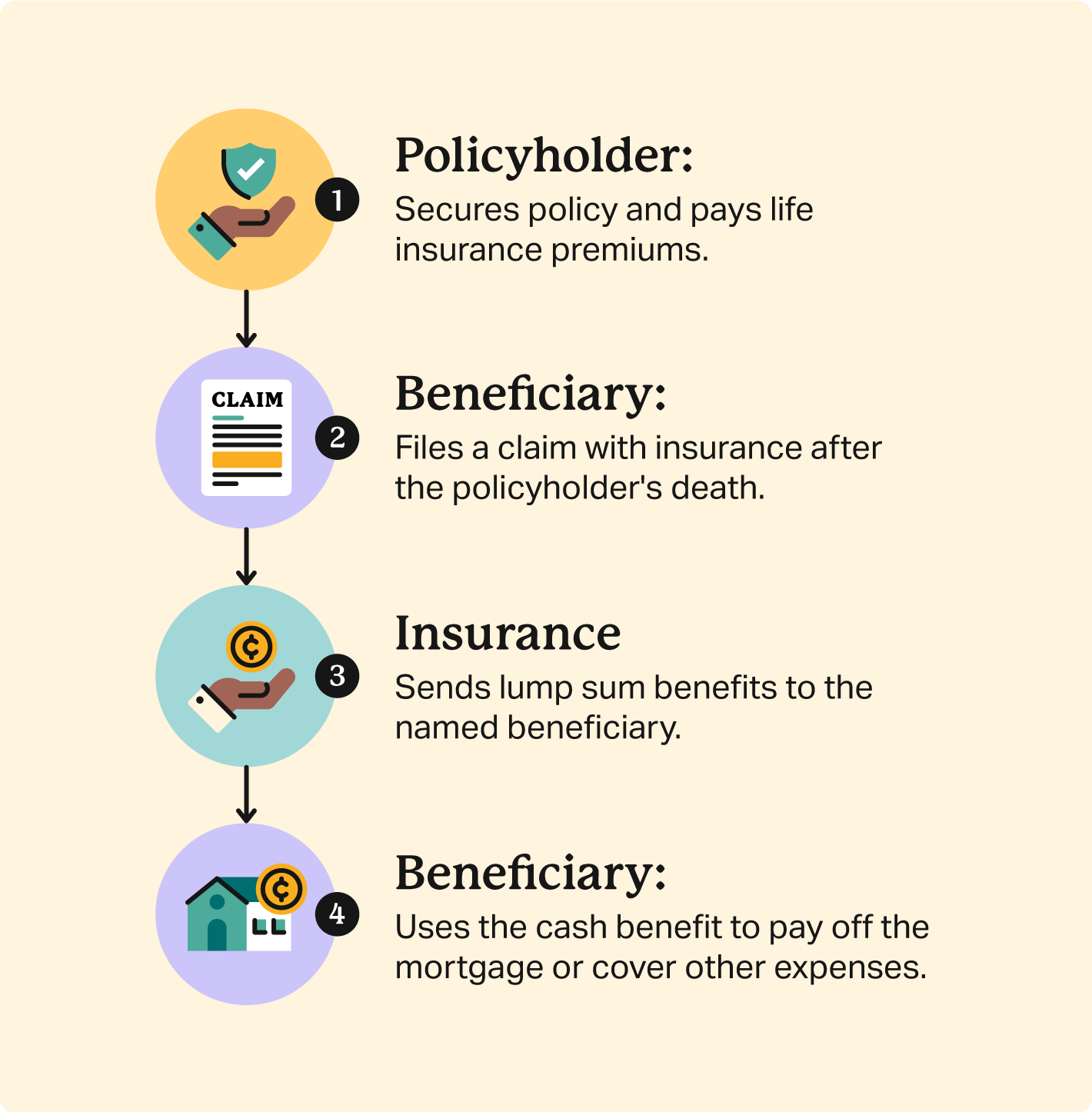

A life insurance coverage plan can help pay off your home's home mortgage if you were to pass away. It is just one of lots of manner ins which life insurance may assist protect your enjoyed ones and their economic future. Among the best ways to factor your home mortgage right into your life insurance policy requirement is to chat with your insurance policy representative.

Rather than a one-size-fits-all life insurance coverage plan, American Household Life Insurance provider supplies plans that can be developed particularly to fulfill your family members's requirements. Below are several of your choices: A term life insurance policy plan. mortgage lenders insurance is energetic for a certain quantity of time and typically uses a bigger amount of insurance coverage at a lower cost than a long-term policy

Rather than just covering a set number of years, it can cover you for your whole life. It additionally has living advantages, such as cash worth build-up. * American Household Life Insurance Company offers various life insurance policies.

Your agent is a fantastic source to address your concerns. They might additionally be able to assist you locate spaces in your life insurance protection or new ways to save money on your various other insurance plan. ***Yes. A life insurance policy recipient can select to use the survivor benefit for anything - buyers protection insurance. It's a great way to assist secure the economic future of your family if you were to pass away.

Life insurance policy is one method of aiding your family in repaying a mortgage if you were to die before the home loan is totally settled. No. Life insurance policy is not mandatory, however it can be a vital part helpful ensure your loved ones are monetarily shielded. Life insurance proceeds might be used to aid pay off a mortgage, but it is not the like home loan insurance coverage that you may be required to have as a problem of a lending.

Where Can I Get Mortgage Insurance

Life insurance policy may assist ensure your residence remains in your family members by providing a survivor benefit that might aid pay for a home loan or make vital acquisitions if you were to pass away. Get in touch with your American Family Insurance representative to discuss which life insurance coverage policy best fits your needs. This is a brief summary of protection and is subject to policy and/or biker conditions, which may vary by state.

The words lifetime, long-lasting and long-term undergo plan terms. * Any kind of lendings taken from your life insurance policy plan will certainly accrue rate of interest. mortgage insurance versus life insurance. Any superior lending equilibrium (lending plus rate of interest) will be subtracted from the death advantage at the time of case or from the cash money value at the time of surrender

Discounts do not apply to the life plan. Policy Kinds: ICC18-33 (10 ), ICC18-33 (15 ), ICC18-34 (20 ), ICC18-35 (30 ), L-33 (10 )(ND), L-33 (15 )(ND), L-34 (20 )(ND), L-35 (30 )(ND), L-33 (10 )(SD), L-33 (15 )(SD), L-34 (20 )(SD), L-35 (30 )(SD), ICC18-36 (10 ), ICC18-36 (15 ), ICC18-36 (20 ), ICC18-36 (30 ), L-36 (10 )(ND), L-36 (15 )(ND), L-36 (20 )(ND), L-36 (30 )(ND), L-36 (10 )(SD), L-36 (15 )(SD), L-36 (20 )(SD), L-36 (30 )(SD), ICC17-225 WL, L-225 (ND) WL, L-225 WL, ICC17-227 WL, L-227 (ND) WL, L-227 WL, ICC17-223 WL, L-223 (ND) WL, L-223 WL, ICC17-224 WL, L-224 (ND) WL, L-224 WL, ICC17-228 WL, L-228 (ND) WL, L-228 WL, ICC21, L141, MS 01 22, L141, ND 02 22, L141, SD 02 22.

Mortgage security insurance (MPI) is a different type of safeguard that could be useful if you're unable to repay your mortgage. While that added defense seems good, MPI isn't for everyone. Below's when mortgage security insurance coverage deserves it. Home loan security insurance coverage is an insurance coverage policy that settles the remainder of your mortgage if you pass away or if you become handicapped and can not work.

Like PMI, MIP secures the lending institution, not you. Nonetheless, unlike PMI, you'll pay MIP for the duration of the finance term, in many cases. Both PMI and MIP are needed insurance coverages. An MPI policy is totally optional. The amount you'll spend for home loan security insurance relies on a range of elements, consisting of the insurer and the existing balance of your home loan.

Still, there are benefits and drawbacks: A lot of MPI plans are released on a "ensured approval" basis. That can be beneficial if you have a health problem and pay high rates permanently insurance policy or battle to get coverage. we protect insurance. An MPI plan can offer you and your family members with a complacency

Mortgage Protect Advantage

It can also be valuable for people that do not certify for or can't afford a traditional life insurance policy plan. You can pick whether you require home mortgage security insurance coverage and for how much time you require it. The terms usually range from 10 to three decades. You could want your home mortgage defense insurance coverage term to be close in length to how much time you have delegated repay your home loan You can cancel a home loan security insurance coverage.

Latest Posts

Instant Online Life Insurance Quotes

Final Expense Life Insurance Rates

Final Expense Insurance Agent