All Categories

Featured

Table of Contents

Our price calculator also includes the Waiver of Premium rider for all carriers. Few other quote devices allow for this. Term Insurance Quantity Top Firm Yearly Regular Monthly Type Age Sex $2,000,000 $1,140.72 $96.96 35 Year Degree Term Guaranteed 31 Female $2,000,000 $1,140.72 $96.96 35 Year Degree Term Assured 31 Female $2,500,000 $1,422.00 $120.16 35 Year Degree Term Guaranteed 31 Female $4,000,000 $2,218.24 $188.55 35 Year Level Term Ensured 31 Female $1,000,000 $481.40 $40.68 30 Year Degree Term Guaranteed 31 Women The following is a quick listing of some of the various other variables that you will certainly need to take into consideration when contrasting products and business in the life insurance policy quotes tool: Company Financial Stamina Not all life insurance coverage companies coincide.

Some firms remain in much better financial problem than others. The longer the level term period, the more vital it is to take into consideration just how healthy and balanced and solid the life insurance coverage company is. Make sure that you ask your agent for info about the economic ratings for the firms that you are thinking about.

If 2 items have the exact same cost, but one is guaranteed while the various other is not, the assured product would certainly be better. Revival Period Many degree term policies have the ability to restore the policy past the preliminary degree costs duration. 2 items might provide similar premiums for the first degree period, and yet there might be a substantial difference in revival prices beyond the degree period.

Regular Monthly Repayment Choices Several consumers pay their term insurance premiums on a month-to-month basis. The least pricey product based upon the annual costs may not have the most affordable monthly, quarterly or semi-annual premium. Numerous life insurance business bill additional to pay more regularly than every year, and some cost greater than others.

A little hypertension might invalidate you for one business's preferred health and wellness costs, but may be acceptable to acquire another business's recommended wellness premium. Your representative will have the ability to give you more advice. Smoking cigarettes Factors to consider Not all life business define smoking similarly. If you have actually never smoked or utilized cigarette products whatsoever, then a non-smoking contrast will certainly consist of products that you can certify for based upon non-smoking.

If you do smoke, some firms may offer items with better premiums relying on just how little you smoke, or whether you smoke cigars or pipe as opposed to cigarettes. You will certainly require to discuss every one of this with your representative. The details used in this life insurance policy quotes contrast has actually been extracted from the rate cards and rate handbooks which life business regularly release and disperse to life agents and brokers.

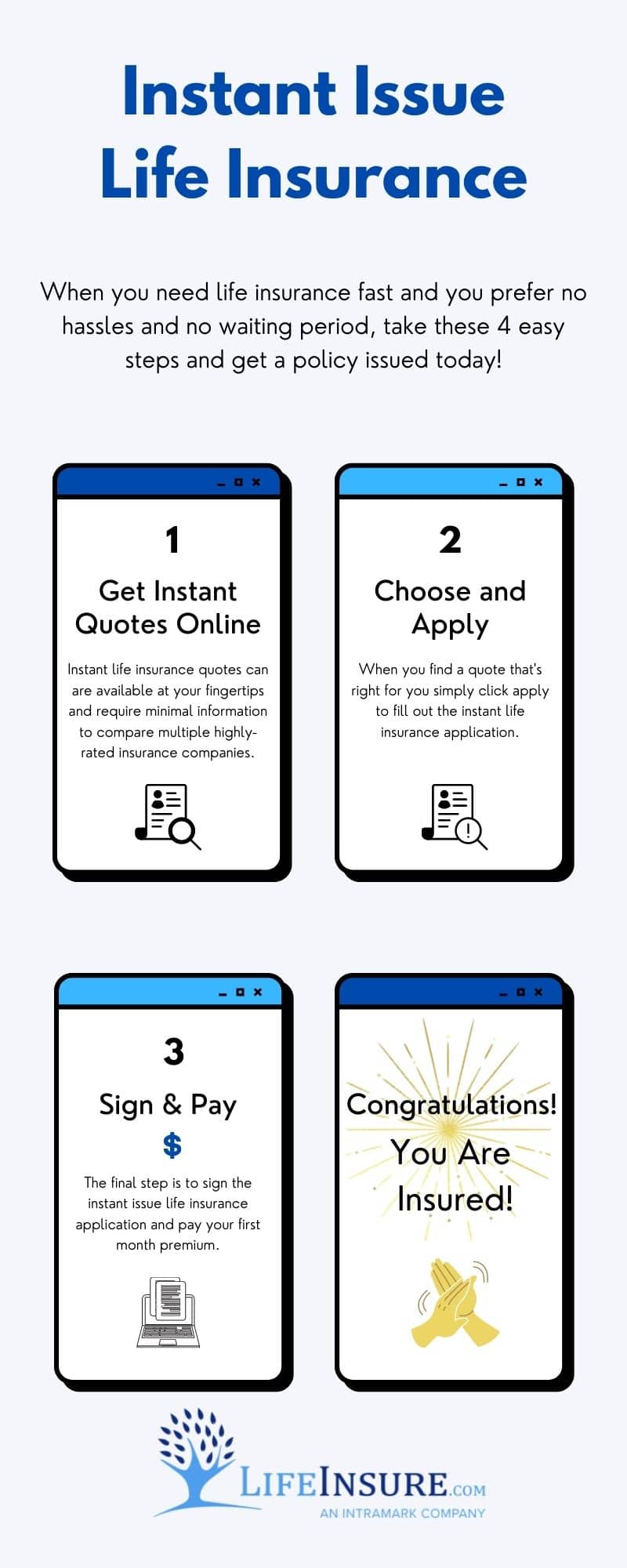

Free Instant Life Insurance Quote

In the occasion that there is an inconsistency in between the details consisted of in this contrast, and any life firm accredited picture and/or plan,.

In enhancement to your age, life insurance coverage prices also depends on your health and wellness. You obtain instantaneous life insurance coverage quotes and every little thing looks good, but you choose to wait on getting a plan.

The bottom line in this example? If you're healthy, do a life insurance coverage quote contrast and apply currently simply in case any unforeseen wellness obstacles appear in the near future that could alter your prices. Keep in mind that insurers can change their rates at any type of time. Occasionally they reduced prices on prominent plans to remain affordable, while various other times, they might increase rates for candidates who stand for a better danger.

1 Some entire life authorities do not have cash money values in the initial 2 years of the policy and don't pay a reward till the policy's 3rd year. 2 Policy benefits are lowered by any kind of superior finance or funding passion and/or withdrawals. Returns, if any, are influenced by policy financings and finance rate of interest.

Universal Life Insurance And Instant Quote

This is a quote based on personal info that you have actually provided and describes particular attributes of a standard policy, which might differ by state. If a policy is released, its stipulations and pricing may vary from this proposition.

The expense for protection is various for everyone and some might be able to get term life insurance for as little as $8.24 a month - get instant life insurance quote. How much your life insurance coverage expenses will certainly depend on just how much insurance coverage you desire, exactly how long you require it for, and points like your age and wellness background.

When respondents were asked to estimate the expense of a $250,000 term life plan for a healthy and balanced 30-year-old, over half said $500 each year or more. In truth, the typical expense is closer to $160, which is more affordable than the ordinary expense for an annual fitness center subscription. According to a report by Cash Under 30, that is around the exact same quantity you could invest in one commercially prepared dish in a restaurant.

Free Term Life Insurance Quotes Instant

However. Generally, the younger and healthier you are, the more budget-friendly your life insurance can be starting at just $16 monthly via eFinancial. * Protection alternatives start at $5,000 and go up to $2 million or even more via eFinancial. Through Progressive Life Insurance Policy Company, protection choices array from $50,000 to $1 million.

Have added concerns? Modern Responses is your resource for all points insurance. See all our life insurance policy ideas and sources.

You can obtain versus your cash money worth if the need develops. Any unsettled financing balance, plus passion, is subtracted from the death benefit. Your eligible spouse can obtain this exact same irreversible protection. A partner includes a lawful partner as defined by state legislation. We motivate you both to consider this coverage to help protect those you leave behind.

Apply online in about 10 minutes. Apply today with confidence. If you are not 100% satisfied for any type of reason, just terminate within the first one month and your costs will certainly be reimbursed completely. No concerns asked. If fatality arises from suicide in the first two years of coverage (one year in ND and CO), we will certainly return every one of the premiums you've paid without interest.

Life Insurance Instant Quote Online

Before requesting any kind of life insurance, below are a few things you need to recognize: In order to examine your application for insurance coverage, CMFG Life Insurance Firm might ask you to finish questions on an application. Through these concerns you will certainly give us with clinical or various other individual details about on your own and any kind of various other person to be guaranteed.

This additional details will certainly aid us better recognize the actions you have supplied on your application. Clinical details we gather concerning you will not be made use of or released for any purpose other than as authorized by you, to underwrite insurance; to provide your policy; explore and report scams; or as required by regulation.

With the collection and use of this details we seek to supply you insurance coverage at the cheapest possible expense. THIS NOTIFICATION IS TO BE READ BY THE APPLICANT FOR INSURANCE COVERAGE.

If you pick to finish the Second Information on the application, that person would likewise receive notice of lapsed protection in the occasion your premiums are not paid. If you select to assign an Additional Addressee in the future, or change the individual you marked, you might do so at any time by composing CMFG Life Insurance Business.

Latest Posts

Instant Online Life Insurance Quotes

Final Expense Life Insurance Rates

Final Expense Insurance Agent